Managing money can be difficult – especially when your head feels clouded by depts, worries about savings, or you’re in the habit of frivolous spending. Gain some clarity and consolidate you incoming and outgoings with these helpful apps.

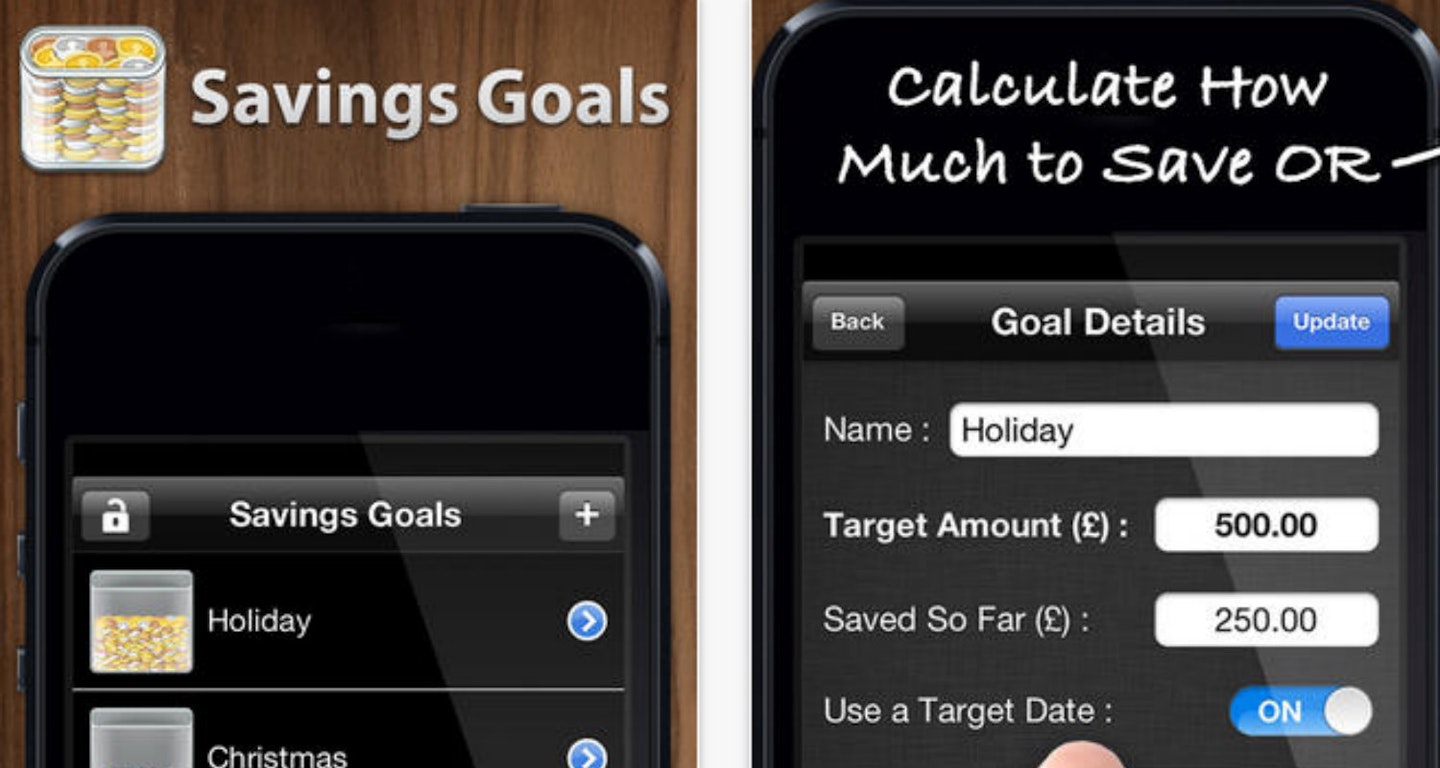

1. For helping you save: Savings Goal

If you’re saving up for a big purchase, this app will help you create a saving schedule you can stick too. Set your goal of how much you want to save by when, and Savings Goal will calculate how much you need to put aside each week to achieve it. It also provides you with various graphs to help you track visualise your progress.

Savings Goal{

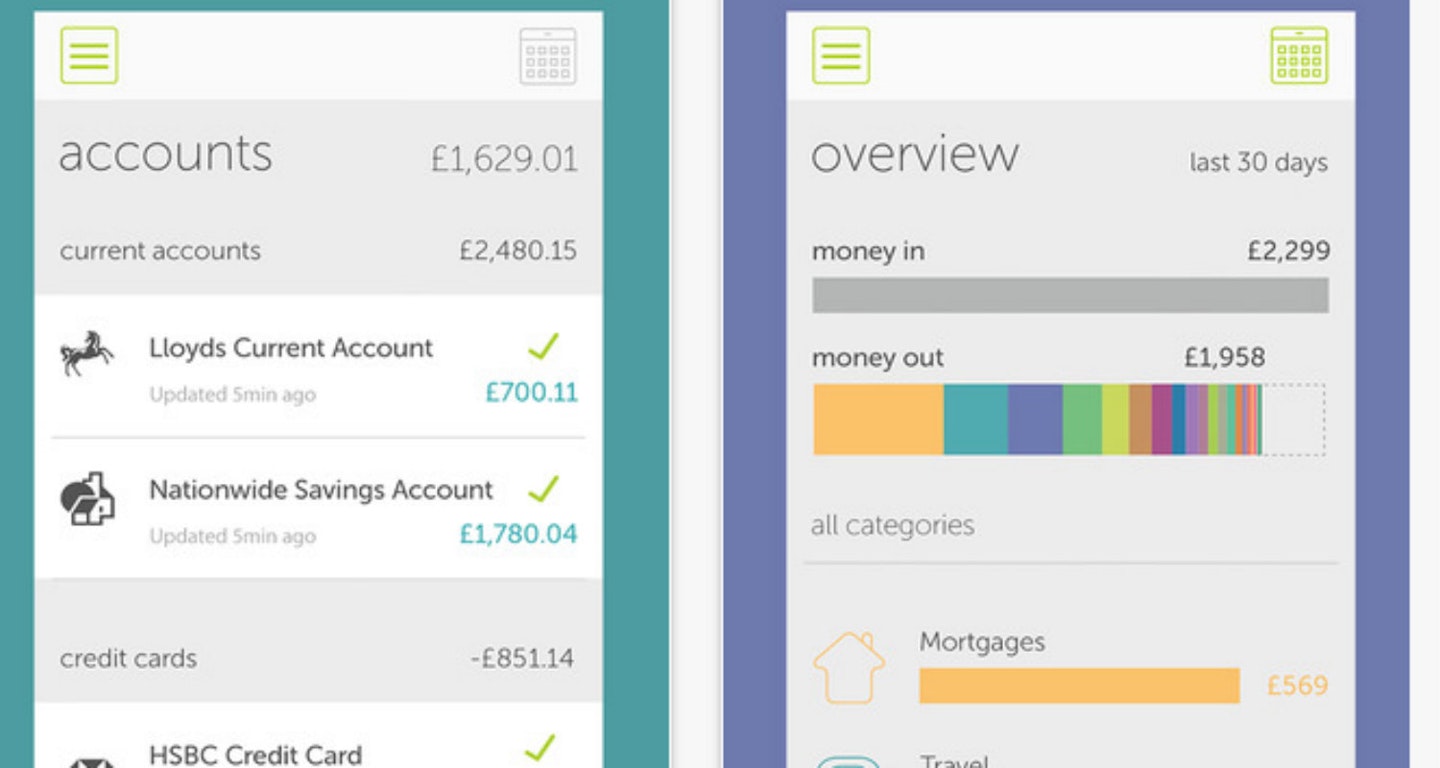

2. For managing accounts simultaneously: The OnTrees

With OnTrees you can connect all your current accounts, credit cards and savings accounts, even if they’re with different banks. You simply need you online login details, and it keep tabs of everything all in one place, making it easier to keep an eye on your overall finances. The nifty app automatically sorts your transactions into categories like rent, travel and groceries, and will update itself overnight. You can also manually edit these categories if you need to.

It also come with other useful features, like the ability to compare your spending habits over the last 7, 30 or 90 days – so you can really take note of that post-pay day spike in spending.

OnTrees, Free

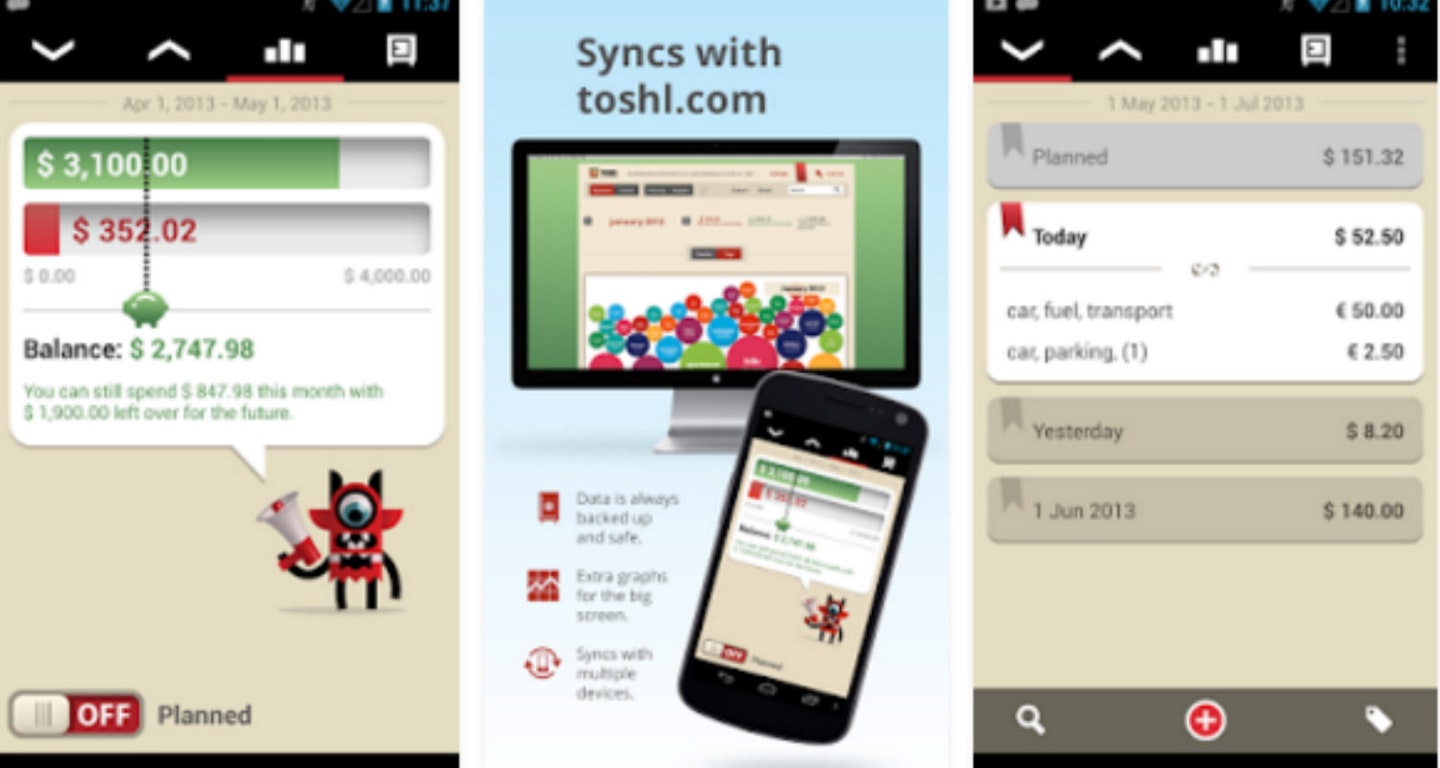

3. For day-to-day budgeting: Toshl

Toshl is an easy-to-use and well designed app that helps you to sort your spending into different categories, including ones you can create yourself. The app will show you how much you spend in each category and the budget calculator will show you how much money you have left for the month.

You can also set a goal amount to spend, so you have money left over for your rainy day fund. In case you forget to add your spending into the app, you can set a daily push notification to help you stay on track.

Toshl, free for iPhone, iPad & Android

4. For managing expenses: Expensify

If you are self-employed or have to keep track of your own expenses Expensify aims to help eliminate some of the hassle. Using its innovative SmartScan technology, you can take pictures of your receipts and upload them to your account, where the app will automatically fill in the expense details or attach the receipts to the relevant credit card expense. Expensify also allows you to track your mileage expenses on the go, which is helpful if you travel a lot for work.

Expensify, free for iPhone and Android.

Expensify, free for iPhone and Android

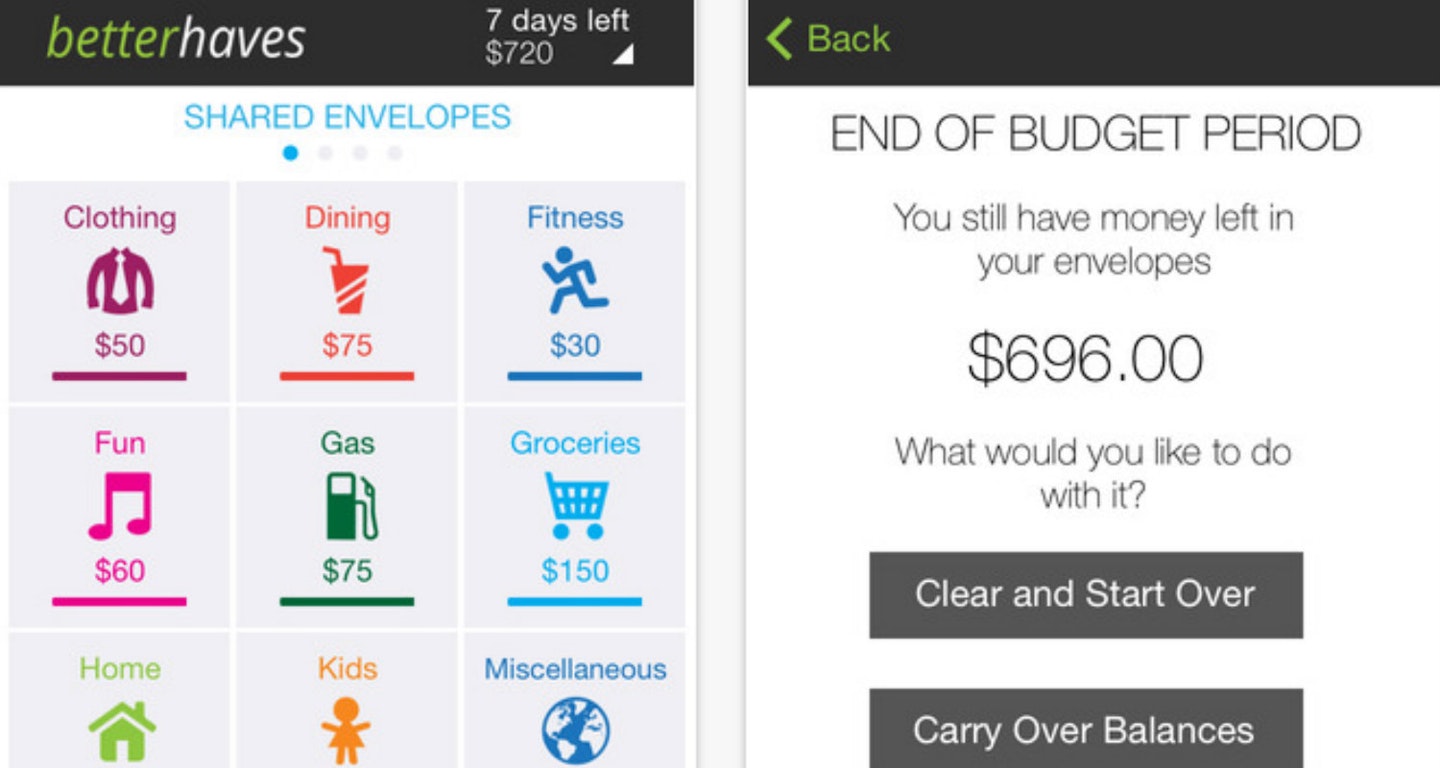

5. For couples: Better Haves

Make it easier to keep an eye on both your accounts with Better Haves, as it allows you to manage a joint budget to keep and eye on spending and save together. You can easily create joint envelopes between you and your partner for things like food, travel, and leisure for the little ones, and make sure you're sticking to your targets between the pair of you.

Better Haves, free for iPhone and Android.